Donald Trump has labeled China's new AI model, DeepSeek, a "wake-up call" for the U.S. tech sector following Nvidia's staggering $600 billion market value loss.

DeepSeek's emergence triggered a sharp decline in AI-heavy company stocks. Nvidia, a GPU market leader crucial for AI model operation, suffered the most, experiencing a 16.86% share plunge—a Wall Street record. Microsoft, Meta Platforms, Alphabet (Google's parent company), and Dell Technologies also saw significant drops, ranging from 2.1% to 8.7%.

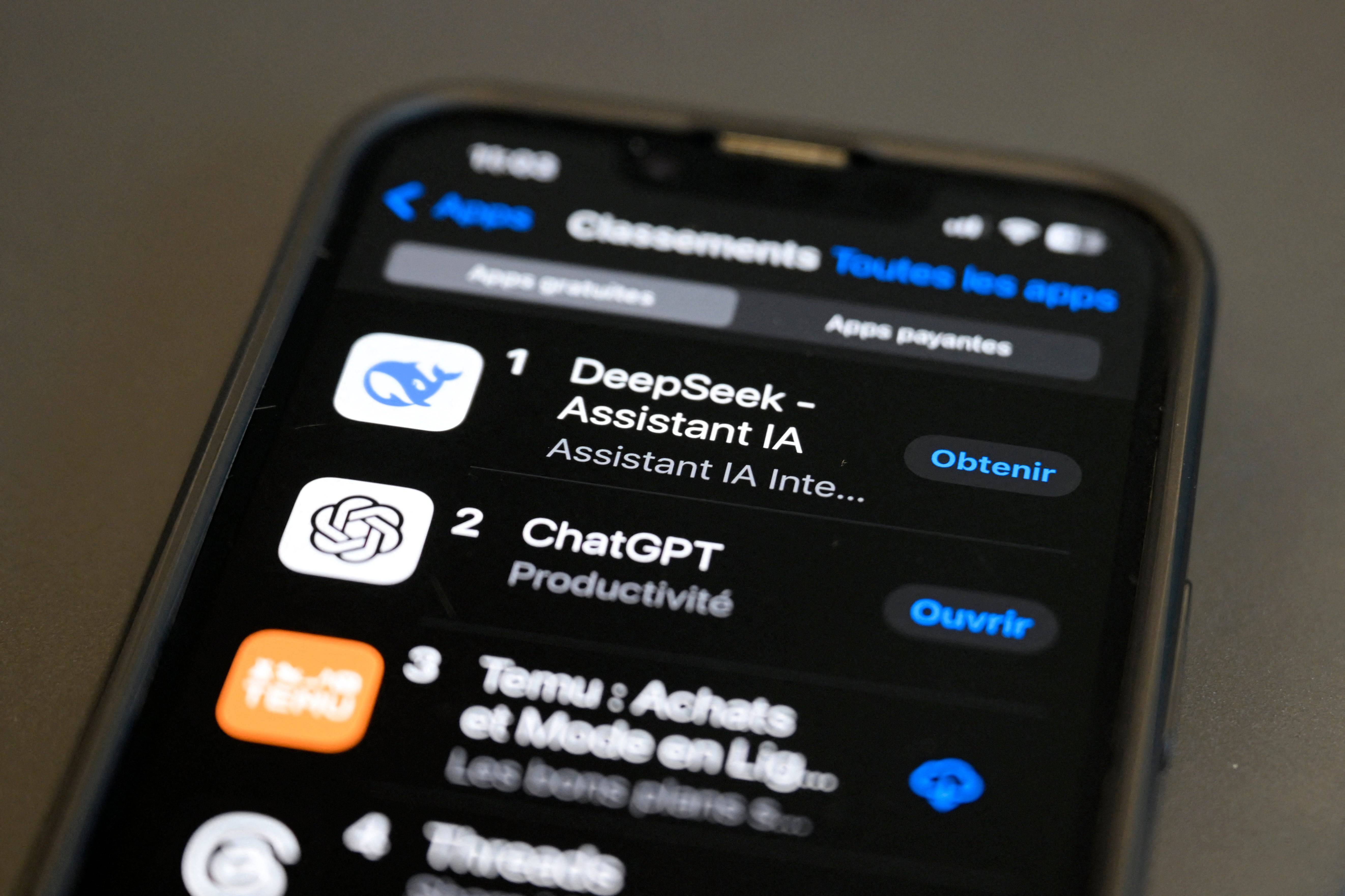

While this claim faces some skepticism, DeepSeek has challenged the massive AI investments of American tech giants, unnerving investors. Its popularity surged, topping U.S. free app download charts amidst growing discussions about its efficacy.

"DeepSeek rivals leading Silicon Valley models, and in some cases, surpasses them," Sheldon Fernandez, DarwinAI co-founder, told CBC News. "The resource efficiency is astounding. Instead of monthly OpenAI subscriptions of $20 or $200, users get comparable features for free, disrupting established business models and high valuations."

Trump, however, offered a more optimistic perspective, suggesting DeepSeek could benefit the U.S. by reducing development costs while potentially achieving similar results. He expressed confidence in continued U.S. AI dominance.

Despite DeepSeek's impact, Nvidia remains a $2.90 trillion company. The highly anticipated RTX 5090 and RTX 5080 GPUs are set for release this week, generating such demand that customers are braving winter conditions to camp outside stores.

Home

Home  Navigation

Navigation

Latest Articles

Latest Articles

Latest Games

Latest Games